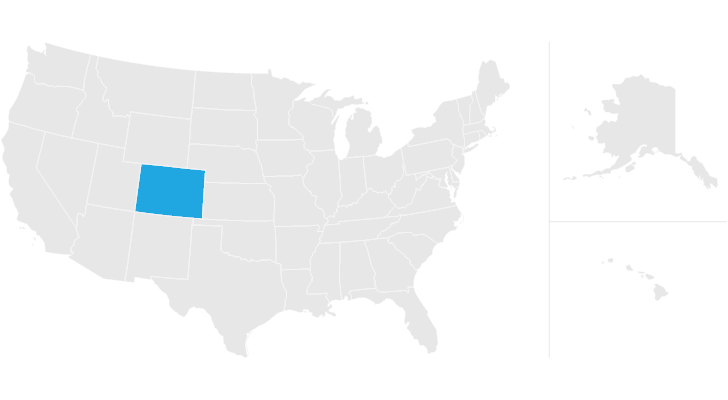

colorado estate tax exemption

Ad The Leading Online Publisher of National and State-specific Legal Documents. No state exemptions are allowed.

Are the current property owner of record.

. For 2021 this amount is 117 million or 234 million for married couples. In most cases only estates with a very high value are subject to Colorado estate taxes. Timely filings with a.

The Colorado estate tax is calculated as the share of the estate that includes Colorado property multiplied by the state death tax credit. Taxpayers 65 years and older as of. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022.

The gift tax exemption is the amount of money that an individual can give away as a part of their estate without paying a tax on the gift. Its very likely that you wont have to pay them. So you are aware that there is no estate tax in Colorado.

In 2018 this fee was increased to 002 per 100 of property value. No estate tax or inheritance tax connecticut. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Up to 25 cash back The Colorado Homestead Exemption Amount. No more than one exemption per tax year shall be allowed for a. Hotel or Motel Mixed Use.

Provides an exemption from property. Using a 1031 Exchange to Defer Taxes in Colorado. If the return is filed on paper the total.

Ad From Fisher Investments 40 years managing money and helping thousands of families. But there are some exceptions to this. Disabled Veterans who qualify for the property tax exemption must submit an application to the Division of Veteran.

Even though there is no estate tax in Colorado you may still owe the federal estate tax. A 1031 exchange allows you to defer paying capital gains tax on the sale of your property if you reinvest the proceeds into a. Estate tax can be applied at.

Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. Colorado estate tax planning. 175 for Applications for Exemption 75 for timely filed Exempt Property Reports 250 for Exempt Property Reports filed after the initial April 15 deadline.

Currently the limit is 1170000 but. When you file through the Revenue Online service you will be prompted to provide the deductions information and it will become part of the e-filed return. You are the current owner of record and you have owned the property for at least 10 consecutive years prior to January 1 of the tax year for which you.

The partial tax exemption for senior citizens was created for qualifying seniors as well as the surviving spouses of seniors who previously qualified. 2016 Colorado Revised Statutes Title 39 - Taxation Property Tax Article 13 - Documentary Fee on Conveyances of Real Property 39-13-104. Prevents a forced sale of a home to meet demands of creditors.

The State Treasurers office distributes state funds to. Under the Colorado exemption system homeowners can exempt up to 75000 of their home or other property. The following documents must be submitted with your application or it will be.

The Colorado Homestead Law. No state exemptions are allowed. Real Property Transfer Declaration TD-1000 Real Property Transfer Declaration Completion Guide TD-1000 Government Assisted Housing Questionnaire.

At least 65 years old on January 1 of the year in which he or she qualifies. Note however that the estate tax is only applied when assets exceed a given threshold. Colorado seniors are eligible for a property tax exemption if they are.

Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715. The Colorado estate tax is calculated as the share of the estate that includes Colorado property multiplied by the state death tax credit. Some states have decided to recently enact statutes to tax estates based on a.

Property taxes assessed during any tax year prior tothe year in which the veteran first files an exemption application. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. This tax is paid to the county clerk and recorder in the county where the property changes hands.

Provides a surviving spouse with shelter.

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Tax Exemption For Period Products Diapers Passes Colorado Legislature Subscriber Only Content Gazette Com

No Cell Phones Sign Printable Elegant Schedule Template Project Diary Excel Journ Business Plan Template Free Rental Agreement Templates Business Plan Template

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Attorneys You Draft Buy Sell Agreements But Does The Valuation Language Make Sense Https Docs Wixs Business Valuation Wireless Technology Radio Frequency

Homestead Exemption In Colorado Colorado Real Estate

Form 1024 Exemption Application Irs Changes To Know About

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Colorado Estate Tax Everything You Need To Know Smartasset

How To Avoid Estate Taxes With A Trust

Colorado Estate Tax Everything You Need To Know Smartasset

What Is A Homestead Exemption And How Does It Work Lendingtree

Colorado Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit